Contents:

One is to teach accounting, since it presents a clear representation of the flow of transactions through the accounts in which transactions are stored. A second use is to clarify more difficult accounting transactions, for the same reason. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. Whether you’re doing manual or electronic accounting for your small business, you should make T-accounts a habit to double-check your financial standing.

The name is based on the way that a T-account appears, with two columns and one line. One problem with T-accounts is that they can be easily manipulated to show a desired result. For example, if you want to increase the balance of an account, you could simply credit the account without recording a corresponding debit. This would create a false positive in the accounting records.

As you see in step 6 of the accounting cycle, we create another trial balance that is adjusted after posting adjusting entries in step 5. Gift cards have become an important topic for managers of any company. Understanding who buys gift cards, why, and when can be important in business planning. Also, knowing when and how to determine that a gift card will not likely be redeemed will affect both the company’s balance sheet and the income statement . The following are selected journal entries from Printing Plus that affect the Cash account.

Streamlining accounts payable

You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side.

In order to get a complete picture of your finances, you need to look at all of your accounts together. This can be difficult to do with T-accounts because you have to flip back and forth between different sheets of paper . I don’t think I’ve used balance sheets in any Twitter arguments yet.

- This informs that you have a balanced account in your general ledger or that an error has occurred in the accounting process.

- This can be difficult to do with T-accounts because you have to flip back and forth between different sheets of paper .

- Adjustments entries are frequently made to make up the differences.

- This visual guide helps you ensure figures are being posted in the correct way, potentially reducing data entry errors.

That is why each account has its own individual ledger account. For example, the fixed assets account would have its own ledger account with only transaction involving fixed assets. A T-account is a tool used within a ledger to represent a specific account, while a ledger is a complete record of all financial transactions for a company.

This balance is transferred to the Cash account in the debit column on the trial balance. Accounts Payable ($3500), Unearned Revenue ($4000), Share Capital ($20000) and Revenue ($5500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the trial balance.

Alert: highest cash back card we’ve seen now has 0% intro APR until 2024

Returning to our example of Edgar Edwards in Activities 1 and 2, the completed trial balance contains all the elements of the accounting equation. This amount is the total as well as the balance in the account. The brought down balances at the end of the accounting period will be the opening balances of the next accounting period.

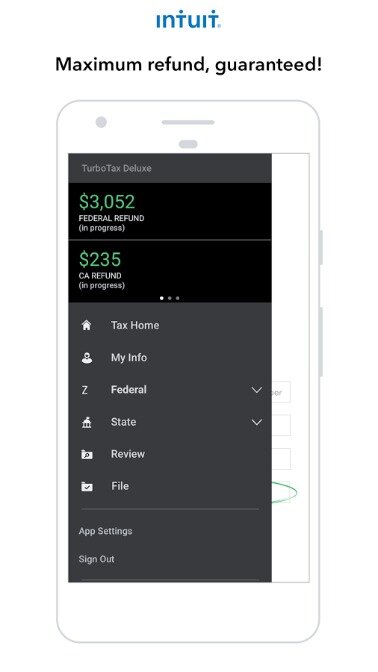

Below, we’ll delve further into how this accounting tool works. If you’re ready to automate the entire accounting process for your small business, be sure to check out The Ascent’s accounting software reviews. T-accounts can be particularly useful for figuring out complicated or closing entries, allowing you to visualize the impact the entries will have on your accounts. Amounts at the top of each debit and credit column should have a dollar sign. The header must contain the name of the company, the label of a Trial Balance, and the accounting period.

If you want to see how your business is doing financially, you’ll need to look at other reports like income statements and balance sheets. T-accounts are a visual representation of how debit and credit transactions impact specific accounts in your double-entry bookkeeping system. While they can be helpful in seeing the relationship between accounts, there are some disadvantages to using them.

Posting to the General Ledger

It is a great tool to use in any type of business where financial transactions take place. Additionally, it allows proper balancing of accounts because discrepancies will be avoided in the recording of each transaction. This gives companies an accurate picture of where they stand financially at any given time. The T-account is a useful tool for businesses of all sizes and can be used in conjunction with other financial tools to track different types of transactions as well.

This is shown in ledger or T-accounts by recording each transaction twice, once as a debit-entry in one account and once as a credit-entry in another account. This is done according to time-honoured rules which treat asset accounts differently from liability accounts and the capital account. An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner’s drawing accounts normally have debit balances.

When Cash Is Debited and Credited

Liabilities decrease on the debit side; therefore, Accounts Payable will decrease on the debit side by $3,500. Cash is decreasing because it was used to pay for the outstanding liability created on January 5. On January 30, 2019, purchases supplies on account for $500, payment due within three months. On January 23, 2019, received cash payment in full from the customer on the January 10 transaction. On January 5, 2019, purchases equipment on account for $3,500, payment due within the month.

TV Review: Stacey Dooley: Ready for war?, Why Didn’t They Ask … – Church Times

TV Review: Stacey Dooley: Ready for war?, Why Didn’t They Ask ….

Posted: Thu, 20 Apr 2023 23:06:59 GMT [source]

Illinois income tax rate entry systems cannot use T-accounts because they do not track the changes in account balances. In a single entry system, each transaction is recorded as a debit or credit to one account. There is no way to track the change in balance over time for a particular account. Many companies have nowadays automated this process through the use of an accounting software.

Soon Parted is the use of T accounts to show balance-sheet relationships. So I am happy to share my technique, which is fast and flexible, although it does require some technical chops. Even small companies can have general ledgers that are more than 1,000 pages when printed out. Obviously, it would be pretty difficult to search through 1,000 pages in order to find information about one account.

Education Savings Accounts, Explained – edweek.org

Education Savings Accounts, Explained.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

This will give the management a holistic view of what is happening in his accounts and if there is anything out of the ordinary occurring. This is consistent with the rules of debit and credit that have been previously mentioned. Posting of these debit and credit transaction to the individual t-accounts provides for an accurate visualization technique for knowing what is happening in each individual account. It provides the management with useful information such as the ending balances of each account which they can then use for a variety of budgeting or financial purposes. Business TransactionsA business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.).

The name comes from the fact that the account is shaped like a capital T, with the debits on the left side of the T and the credits on the right side. T-accounts are used to track individual account balances and transactions, while trial balance summaries are used to ensure the overall accuracy of a company’s financial records. A ledger is a complete record of all financial transactions for a company, organized by account. It includes a list of all T-accounts and their balances, providing a comprehensive view of a company’s financial position. Ledgers can be maintained manually or electronically, and they serve as the basis for financial statements and other reports. Your profit & loss organises your revenue and expense accounts whilst your balance sheet organises your asset, liability and equity accounts.

T-accounts are typically used by bookkeepers and accountants when trying to determine the proper journal entries to make. Here are some times when using T-accounts can be helpful. When you’re ready to use T-accounts, you can use them separately, in order to view journal entry details, or you can enter the transaction directly into your journal. If your company’s balance sheet is not portraying an accurate picture, you’re shooting in the dark.

The account title is written above the horizontal part of the “T”. On the left-side of the vertical line, the debit amounts are shown. Accountants and bookkeepers often use T-accounts as a visual aid to see the effect of a transaction or journal entry on the two accounts involved.

Why your Twitter page may have a dog on it and other changes to the app – Vox.com

Why your Twitter page may have a dog on it and other changes to the app.

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

In the following example of how T accounts are used, a company receives a $10,000 invoice from its landlord for the July rent. The T account shows that there will be a debit of $10,000 to the rent expense account, as well as a corresponding $10,000 credit to the accounts payable account. This initial transaction shows that the company has incurred an expense as well as a liability to pay that expense. Indouble-entry bookkeeping, a widespread accounting method, all financial transactions are considered to affect at least two of a company’s accounts.